Cryptocurrency trading has become a global phenomenon, with millions of investors participating in the market. As more people enter the space, the need for efficient and cost-effective trading platforms has never been more critical. In this article, we will explore the realm of crypto exchanges with a specific focus on those offering the lowest fees, ensuring that every transaction maximizes profitability.

Introduction

Cryptocurrency exchanges serve as the backbone of the digital asset market, providing a platform for users to buy, sell, and trade various cryptocurrencies. The fees associated with these exchanges play a pivotal role in determining the overall cost of trading. While some platforms charge exorbitant fees, others pride themselves on offering competitive rates, making them attractive to a wide range of traders.

Understanding Crypto Exchange Fees

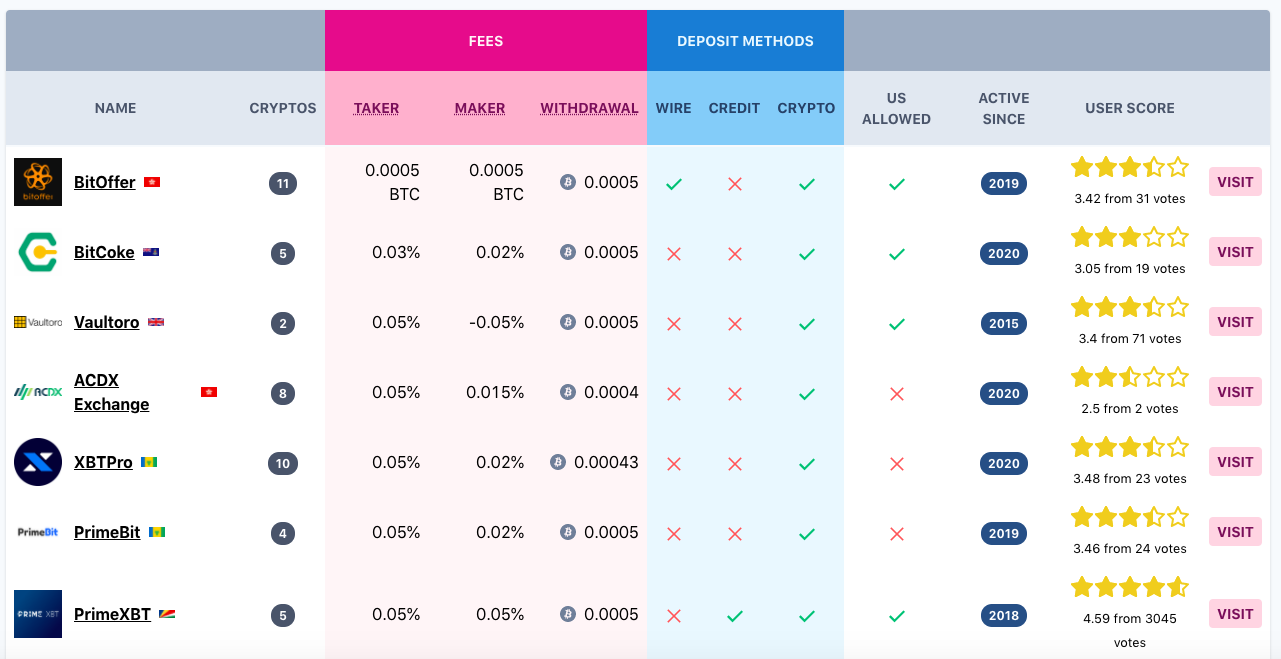

Before delving into the exchanges with the lowest fees, it’s essential to understand the different types of fees prevalent in the crypto space. Transaction fees, withdrawal fees, and deposit fees are common aspects that users need to consider. Comparatively, traditional financial institutions often impose higher fees, making crypto exchanges a cost-effective alternative.

Factors to Consider When Choosing a Crypto Exchange

Selecting the right crypto exchange involves considering various factors beyond just low fees. Transparency in fee structures, robust security features, the availability of a diverse range of cryptocurrencies, and an intuitive user interface all contribute to a seamless trading experience.

Top Crypto Exchanges with Lowest Fees

Binance: A Pioneer in Low-Fee Trading

Binance, one of the leading crypto exchanges globally, has gained immense popularity for its low transaction fees. With a user-friendly interface and a vast array of supported cryptocurrencies, Binance remains a top choice for traders seeking cost-effective solutions.

Kraken: Striking the Balance

Kraken stands out for its commitment to keeping fees low while maintaining a strong focus on security. Traders appreciate the platform’s transparency in fee structures, making it an attractive option for both beginners and experienced investors.

Coinbase Pro: Affordable and Accessible

Coinbase Pro, the professional trading platform by Coinbase, boasts competitive fees and a straightforward user experience. It provides a seamless transition for users familiar with Coinbase’s user-friendly interface, making it an accessible choice for many.

Gemini: Security and Affordability Combined

Gemini has positioned itself as a secure and cost-effective option for cryptocurrency enthusiasts. With a robust security infrastructure and reasonable fee structures, Gemini appeals to users prioritizing both safety and affordability.

Binance: A Closer Look

Binance, founded in 2017, quickly became a household name in the crypto world. The platform offers a straightforward fee structure, with trading fees starting at 0.1%. Additionally, Binance provides further discounts for users holding its native cryptocurrency, BNB.

User testimonials highlight the efficiency and cost savings experienced on the platform. Traders appreciate the liquidity of the market on Binance, allowing for seamless execution of trades at competitive rates.

Kraken: Keeping Fees Low

Kraken, established in 2011, prides itself on maintaining low fees while providing advanced trading features. The platform’s fee structure is tiered based on a user’s trading volume, rewarding high-volume traders with reduced fees.

Feedback from Kraken users emphasizes the platform’s commitment to security, with many users expressing confidence in the safety of their funds. The combination of low fees and a focus on security positions Kraken as a reliable choice in the crypto landscape.

Coinbase Pro: Affordable Trading

Coinbase Pro, the professional trading arm of the popular Coinbase platform, offers an intuitive interface and competitive fee structures. With trading fees starting at 0.5% and decreasing based on trading volume, Coinbase Pro attracts a diverse user base.

Users appreciate the seamless transition between Coinbase and Coinbase Pro, enabling a straightforward experience for those looking to delve into professional trading. Coinbase Pro’s commitment to affordability and user experience solidifies its position among the top low-fee crypto exchanges.

Gemini: A Secure and Cost-Effective Option

Gemini, founded in 2014 by the Winklevoss twins, prioritizes both security and affordability. The platform’s fee structure is transparent, with fees starting at 0.5% for both buyers and sellers. Gemini’s commitment to regulatory compliance adds an extra layer of trust for users.

User experiences on Gemini often highlight the platform’s user-friendly interface and the peace of mind that comes with its security measures. Gemini’s emphasis on compliance and low fees positions it as an attractive choice for those seeking a reliable and cost-effective trading platform.

Strategies for Minimizing Fees

Beyond choosing a low-fee exchange, traders can employ strategies to further minimize costs. Utilizing limit orders, timing the market effectively, and carefully selecting cryptocurrencies can contribute to significant savings over time.

The Impact of Low Fees on Trading Profits

Low fees directly impact a trader’s profits by reducing the overall cost of transactions. The article explores real-world examples of cost savings and discusses how choosing a low-fee exchange can contribute to long-term financial gains.

Security Concerns and Low-Fee Exchanges

While low fees are appealing, maintaining a balance with robust security measures is crucial. The article addresses the importance of security in the crypto space and provides tips for secure trading on low-fee exchanges.

Real User Experiences

Understanding the real-world experiences of individuals using low-fee exchanges adds a practical dimension to the article. Testimonials from traders highlight both the benefits and challenges associated with choosing platforms with the lowest fees.

Common Misconceptions About Low-Fee Crypto Exchanges

Addressing misconceptions is essential to provide a balanced perspective. The article dispels common myths and concerns associated with low-fee crypto exchanges, ensuring readers have a clear understanding of the advantages.

Future Trends in Crypto Exchange Fees

As the crypto landscape evolves, so do fee structures. The article delves into predictions for the future of crypto exchange fees, offering insights into how the industry might adapt to meet the changing needs of traders.

Conclusion

In conclusion, selecting a crypto exchange with low fees is a strategic decision that can significantly impact a trader’s overall profitability. Platforms like Binance, Kraken, Coinbase Pro, and Gemini exemplify the possibilities of combining affordability with security. By understanding the intricacies of fee structures, employing cost-saving strategies, and prioritizing security, traders can navigate the crypto landscape with confidence.

FAQs

- Are low-fee crypto exchanges safe?

- Low-fee exchanges can be safe if they prioritize security measures. It’s crucial to research and choose platforms with a proven track record of safeguarding user funds.

- How do limit orders help minimize fees?

- Limit orders allow traders to specify the price at which they want to buy or sell. This can help avoid market orders and potentially reduce trading fees.

- What cryptocurrencies are available on low-fee exchanges?

- The availability of cryptocurrencies varies, but popular options like Bitcoin, Ethereum, and Litecoin are typically supported on low-fee exchanges.

- Do low fees mean compromised features?

- Not necessarily. Many low-fee exchanges offer a wide range of features, including advanced trading options, without compromising on security or user experience.

- How can I predict future trends in crypto exchange fees?

- While predictions are speculative, staying informed about industry developments, regulatory changes, and technological advancements can offer insights into potential future trends.